Enquire in 60 secs, apply in 5 mins, paid in as little as 4 hours

.svg)

Just tell us the basics about your business — it’s quick, easy, and only takes a minute. An enquiry won't affect your credit score.

With access to 50+ funders, as well as our own book, we compare every option and present you with the best offer for your business.

Once approved, and with your documents ready, we can send the money in just a few hours.

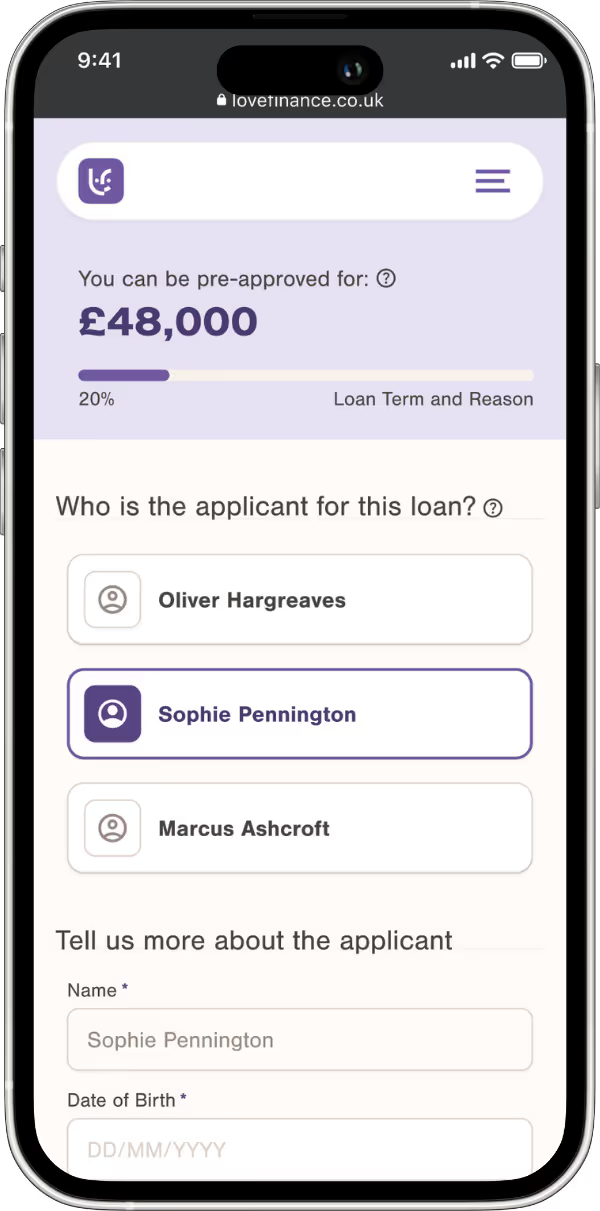

Our easy-to-use dashboard helps you apply for a loan without the stress.

Tell us a little bit about yourself, business and loan purpose.

No paperwork hassle — just drag, drop, and you’re done.

We’ve got everything we need to find you your best deal.

.avif)

Borrow up to £750k, unsecured, for almost any purpose.

Behind every loan is a business with big plans. Here are some of the stories from people we’ve helped grow, adapt, and take the next step.

Have a flick through!